The FIRE (Financial Independence, Retire Early) movement has taken the world by storm, capturing the imaginations of millennials and Gen Z who yearn for a life beyond the traditional 9-to-5 grind. FIRE isn’t just about retiring early; it’s a lifestyle that empowers individuals to take control of their finances and design a life on their own terms. Imagine having the freedom to pursue your passions, travel the world, or simply spend more time with loved ones – all without the constraints of a traditional job.

At its core, FIRE is about achieving financial independence, where your investments and savings generate enough passive income to cover your living expenses. This allows you to retire early, or at the very least, have the flexibility to choose work that aligns with your values and interests.

While the allure of FIRE is undeniable, achieving it requires careful planning and disciplined money management. It’s not a get-rich-quick scheme but a long-term strategy that involves making smart financial choices and maximizing your resources. In this comprehensive guide, we’ll delve into the essential money management tips that can pave the way for your FIRE journey. From budgeting and saving hacks to investment strategies and lifestyle adjustments, we’ll equip you with the knowledge and tools you need to build a solid financial foundation and achieve the financial freedom you desire. Whether you’re just starting or already on your path to FIRE, this article will provide valuable insights and practical advice to help you reach your goals faster and with greater confidence.

Understand the core principles of FIRE

At its core, FIRE is a financial philosophy that prioritizes saving and investing a large portion of your income to achieve financial independence and retire early. The ultimate goal is to accumulate enough wealth to generate passive income that covers your living expenses, allowing you to leave the traditional workforce on your own terms.

Three key factors play a crucial role in achieving FIRE:

- Savings Rate: This refers to the percentage of your income that you save and invest. A higher savings rate translates to faster wealth accumulation and a shorter path to FIRE. Many FIRE enthusiasts aim for a savings rate of 50% or more, but even smaller percentages can make a significant difference over time.

- Investment Returns: Your investment returns determine how quickly your money grows. While there’s no guarantee of specific returns, historically, the stock market has provided an average annual return of around 7-10%. Investing wisely can help you maximize your returns and reach FIRE sooner.

- Living Expenses: Your expenses directly impact how much money you need to save for FIRE. By adopting a frugal lifestyle and minimizing unnecessary spending, you can significantly reduce the amount you need to accumulate and accelerate your journey to financial independence.

The beauty of FIRE is its adaptability. It’s not a rigid formula, but rather a customizable framework that can be tailored to align with your individual priorities and lifestyle preferences. Let’s explore some of the most popular FIRE variations:

- Lean FIRE: This involves living a minimalist lifestyle with a focus on frugality and low expenses. It requires a smaller nest egg but may involve sacrifices in terms of lifestyle choices.

- Fat FIRE: This allows for a more luxurious lifestyle with higher expenses. It requires a larger nest egg and often involves higher income or more aggressive investment strategies.

- Barista FIRE: This hybrid approach involves working part-time or pursuing a passion project while relying on investments for partial income. It offers a balance between early retirement and continued work.

Understanding these core principles and different FIRE variations is essential for tailoring your approach to your individual goals and circumstances. By carefully considering your savings rate, investment returns, and desired lifestyle, you can create a personalized FIRE plan that aligns with your values and aspirations.

Create a FIRE Financial Plan

Creating a comprehensive financial plan is the foundation upon which your FIRE (Financial Independence, Retire Early) journey is built. It serves as your compass, guiding you towards your desired destination of financial freedom. Let’s delve into the essential steps of building this crucial roadmap:

Define Your FIRE Vision:

The first step is to crystallize your FIRE aspirations. Answer the following questions:

- Retirement Age: Envision the age at which you desire to achieve financial independence and potentially retire early. This will depend on your personal values, lifestyle preferences, and retirement aspirations.

- Dream Lifestyle: Paint a vivid picture of your ideal retirement lifestyle. What activities will bring you joy? Where do you want to live? How much will you spend on travel, hobbies, and other pursuits?

- Target Nest Egg: Calculate the amount of money you’ll need to have saved to fund your dream retirement lifestyle. Consider factors like your estimated annual expenses, projected inflation rates, desired retirement duration, and potential healthcare costs.

Calculate Your FIRE Number:

Your FIRE number is the magic figure that represents the amount of money you need to accumulate to achieve financial independence. Several calculation methods can help you arrive at this crucial number:

- The 4% Rule: This widely used rule of thumb suggests that you can safely withdraw 4% of your investment portfolio annually in retirement without depleting your nest egg. To calculate your FIRE number using the 4% rule, simply multiply your estimated annual expenses by 25 (the reciprocal of 4%). For example, if your annual expenses are projected to be $50,000, your FIRE number would be $1,250,000.

- Cash Flow Approach: This method is more flexible, adjusting your withdrawal amount based on your actual living expenses and investment returns. It adapts better to market changes, ensuring your money lasts throughout your retirement. Our WeFire App utilizes the cash flow approach, providing personalized withdrawal strategies to help you enjoy your retirement while maintaining financial security.

Strategize and Implement:

Once you’ve defined your FIRE goals and calculated your FIRE number, it’s time to develop a strategic plan for reaching your financial independence milestone. This plan will involve:

- Aggressive Saving: Maximize your savings rate by tracking your income and expenses, identifying areas to cut back, and automating your savings.

- Smart Investing: Choose investment vehicles aligned with your risk tolerance and time horizon. Consider diversifying your portfolio across various asset classes to mitigate risk and potentially enhance returns.

- Expense Management: Consciously manage your expenses by distinguishing between needs and wants, prioritizing value over impulse purchases, and embracing a frugal mindset.

- Income Optimization: Explore avenues to increase your income, such as seeking career advancement, pursuing side hustles, or starting a business.

Track, Review, and Adapt:

Your FIRE plan is not a static document. It’s a dynamic roadmap that should evolve alongside your life circumstances and financial goals. Regularly review your progress, track your spending, monitor your investments, and reassess your FIRE timeline. Be prepared to adjust your plan as needed if you experience unexpected changes in income, expenses, or investment returns.

Empower Your FIRE Journey with WeFIRE

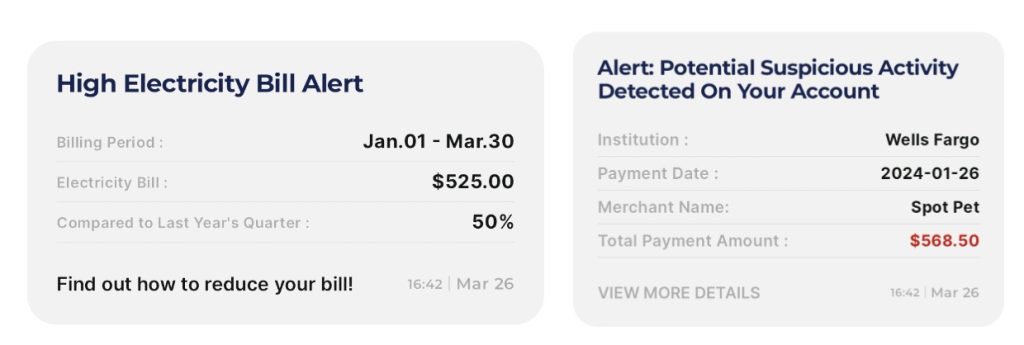

Navigating the complexities of FIRE planning can be daunting, but you don’t have to do it alone. The WeFIRE app is your personal AI-powered financial copilot, designed to simplify and streamline your path to financial independence.

With WeFIRE, you have a suite of tools and insights at your fingertips, from a built-in FIRE calculator using the adaptable cash flow approach to personalized advice and educational resources. Whether you’re just starting your FIRE journey or well on your way, WeFIRE can be a valuable companion, providing the support you need to achieve your financial independence dreams (click here to learn about WeFIRE).

Supercharging Your Savings Rate

Boosting your savings rate is a potent lever you can pull to fast-track your journey to FIRE (Financial Independence, Retire Early). By accelerating your wealth accumulation, you shorten the timeline to financial freedom. It’s a dual approach that involves maximizing your income and minimizing your expenses. Let’s delve into actionable strategies to supercharge your savings:

Ignite Your Income

- Side Hustles: Unleash Your Potential: Tap into your passions, skills, and hobbies to identify lucrative side hustle opportunities. The digital age offers a plethora of possibilities, from freelance writing and graphic design to virtual assistance and online tutoring. Explore platforms like Upwork, Fiverr, or Etsy to showcase your talents and connect with potential clients.

- Career Advancement: Invest in Your Future: Your career is your most significant income-generating asset. Invest in continuous learning and professional development to expand your skill set and open doors to higher-paying positions. Pursue advanced degrees, certifications, or specialized training programs that align with your career goals. Actively network with colleagues and mentors to stay abreast of industry trends and opportunities.

- Salary Negotiation: Know Your Worth: Don’t shy away from negotiating your salary or requesting a raise when your performance merits it. Research industry benchmarks, prepare a compelling case highlighting your achievements, and confidently articulate your value to your employer. Remember, your compensation is an ongoing negotiation.

- Entrepreneurship: Forge Your Own Path: If you possess an entrepreneurial spirit and a viable business idea, starting your own venture can be a game-changer for your income potential. Thoroughly research your market, develop a solid business plan, and secure adequate funding. While entrepreneurship comes with risks, the rewards can be substantial.

Streamline Your Expenses

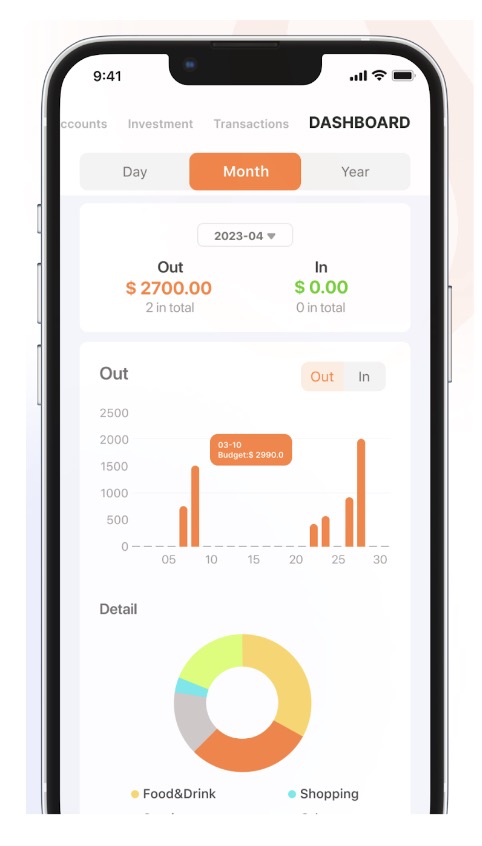

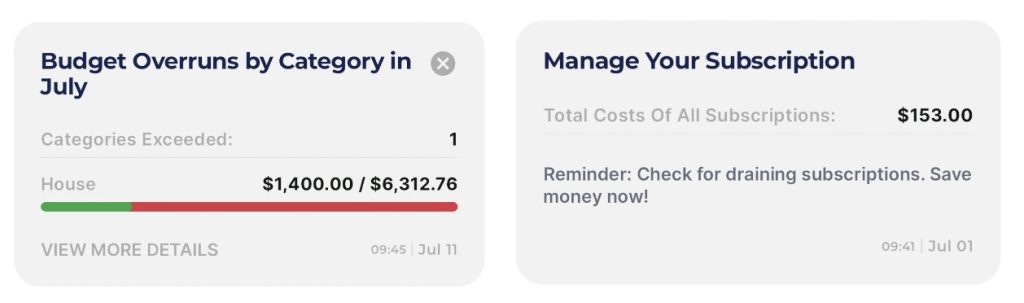

- Budgeting Mastery: Gain Financial Clarity: Creating a detailed budget is the cornerstone of expense management. Track every penny you earn and spend, categorizing your expenses to identify areas where you can cut back. Utilize budgeting apps to automate this process and gain a clear picture of your financial inflows and outflows.

- Needs vs. Wants: Prioritize Essentials: Differentiate between your needs and wants. While indulging in occasional treats is perfectly fine, prioritize spending on essential items like housing, food, transportation, and utilities. Challenge yourself to find cost-effective alternatives without sacrificing quality.

- Debt Elimination: Break Free from Shackles: High-interest debt, such as credit card balances or personal loans, can drain your finances and hinder your FIRE progress. Create a debt repayment plan, focus on paying off the highest-interest debts first, and consider debt consolidation strategies to streamline your payments.

- Frugal Living: Embrace Simplicity: Frugal living doesn’t mean deprivation; it means making conscious choices about your spending. Embrace DIY projects, cook at home more often, use public transportation or bike instead of driving, and seek out free or low-cost entertainment options.

WeFIRE: Your Partner in Mindful Spending

The WeFIRE app can be your ultimate companion in cultivating mindful spending habits. With its intuitive budgeting tools, spending trackers, and personalized insights, WeFIRE empowers you to take control of your finances and make conscious choices that align with your FIRE goals. By harnessing the power of technology and adopting these mindful spending practices, you can create a sustainable financial path toward early retirement and the freedom to live life on your own terms.

Making Your Money Work for You

Investing is the engine that propels your FIRE journey, accelerating your wealth accumulation and bringing financial independence closer. It’s about putting your hard-earned savings to work, generating passive income that eventually replaces your need for a traditional paycheck. However, it’s crucial to approach investing with a strategic mindset, aligning your choices with your risk tolerance and long-term FIRE goals.

FIRE-Friendly Investment Options:

- Index Funds: The Simple and Effective Path: Index funds are investment vehicles that track a specific market index, such as the S&P 500 or the Nasdaq Composite. They offer instant diversification by holding a basket of stocks or bonds that mirror the index’s composition. Index funds are favored by FIRE enthusiasts for their simplicity, low fees, and historical track record of delivering solid returns over the long term. They require minimal maintenance and are an excellent choice for beginners and seasoned investors alike.

- Stocks: The Potential for Higher Returns: Investing in individual stocks can be a rewarding endeavor, offering the potential for higher returns than index funds. However, it often comes with greater volatility. Thorough research and a solid understanding of market dynamics are essential for successful stock picking. It’s advisable to diversify your stock portfolio across different sectors and industries to mitigate risk.

- Real Estate: Building a Tangible Asset: Real estate investing can be a lucrative avenue for FIRE enthusiasts. It offers the potential for rental income, property appreciation, and tax benefits. However, real estate requires substantial capital, ongoing management, and knowledge of local market conditions. Consider options like rental properties, REITs (Real Estate Investment Trusts), or real estate crowdfunding platforms to get started.

- Other Options: Diversifying Your Portfolio: Depending on your risk appetite and financial knowledge, you can explore other investment options like bonds, peer-to-peer lending, dividend-paying stocks, or even starting your own business. Diversifying appropriately helps spread risk and ensures that your portfolio isn’t overly reliant on a single asset class.

Key Principles for FIRE Investing:

- Long-Term Focus: The Tortoise Wins the Race: FIRE investing is a marathon, not a sprint. Avoid the temptation to chase short-term gains or react impulsively to market fluctuations. Instead, focus on long-term growth and allow compound interest to work its magic over time.

- Only Invest What You Know: Stick to investments you understand well. As Warren Buffett wisely advises, “Never invest in a business you cannot understand.” This means avoiding complex investments or those beyond your comprehension, thereby minimizing the chances of making poor investment choices based on incomplete or misunderstood information.

- Align Investment Horizons: Keep short-term money liquid. Investing funds that you might need in the near future into long-term assets like stocks can lead to financial strain if you have to sell these investments prematurely, potentially at a loss. Maintain a balance between liquid assets and long-term investments to ensure financial stability and flexibility.

- Risk Management: Know Your Limits: Understand your risk tolerance and invest accordingly. Avoid speculative investments that could jeopardize your financial security. If you’re unsure, consult with a professional financial advisor to create a personalized investment plan that aligns with your goals and risk profile.

- Regular Contributions: Consistency is Key: Make regular contributions to your investment accounts, even if it’s a small amount. This dollar-cost averaging approach helps you buy more shares when prices are low and fewer shares when prices are high, averaging out your cost basis over time.

Conclusion

The path to FIRE is a personal journey that demands dedication, discipline, and savvy financial decision-making. By understanding the fundamental principles of FIRE, establishing clear goals, accelerating your savings rate, making informed investment choices, and adopting a mindful lifestyle, you can pave the way to financial independence and early retirement.

Remember, FIRE is not a cookie-cutter approach. It’s about crafting a financial plan that aligns with your unique aspirations and values. Take that first step today: create a budget, explore potential side hustles, or invest in your education. Every small step you take propels you closer to your dream of financial freedom.

For further guidance and a wealth of information, be sure to explore our “WeFIRE Library.” (click here) Immerse yourself in the thriving FIRE community, learn from the experiences of others, and share your own journey. Your future self will be immensely grateful for the actions you take today.

Click here to dive into articles on:

Am I Too Old to Start Saving for Retirement?

FIRE Budgeting 101: Your Essential Guide to Financial Independence

WeFIRE Newsletter

A weekly roundup of money news, budgeting hacks, tax strategies, book reviews, and bursts of inspiration to support you on your path to financial independence.

Ellie Yan