How achievable is this goal? Although not the typical early retiree, nurses are well positioned to retire in their 50’s (or even earlier) thanks to certain unique aspects of their job, these being, high wages, good retirement benefits, and shorter work weeks.

Aside from these factors that nurses are uniquely positioned to leverage, there are also many highly effective techniques that are available to anyone of any profession. These are making a budget, paying off your debts, high yield savings accounts, stock investing, tax shelters, and other investments

Nurses Who Want to Retire Early Have an Advantage

According to the US Bureau of Labour Statistics, 91% of nurses have access to retirement benefits while only 73% of average US workers have access. An employer offering better benefits likely offers lower pay.

High Wage

Nurses are a vital part of the healthcare system so they are compensated well for their work. A new grad registered nurse can expect anywhere from $25 to $50 per hour depending on their county and employer. In general, county hospitals offer lower pay but better benefits, while private hospitals offer higher pay but less comprehensive benefits.

Many nurses are also offered a differential in addition to their base pay. Nurses who work on the weekend or in the evenings frequently receive additional compensation to the tune of about 10% for weekends and 20% for night shifts (30% for night shifts on the weekend).

Good Retirement Benefits

There are many types of work benefits available to nurses, from sick leave and vacation days to tuition reimbursement and wellness programs. For now, we will focus on retirement benefits. Depending on your employer, you may be offered any of the following retirement plans.

-

- 401(k) – Has annual contribution limit, employer match optional, offered in the private sector

-

- 403(b) – Lower employer match rate than 401(k), employees with 15 years of service with one employer can make additional contributions, strictly for government and non-profit employees

-

- 457(b) – Looser rules for early withdrawal without penalty, employer match is rare, employer match count towards contribution limit, limited investment options compared to 401(k), for employees of state and local government employees and nonprofits

-

- 401(a) – Employer match mandatory, employers can make participation mandatory, employees are eligible after 2 years (only 1 year for 401k), investment options generally fewer and more conservative than 401(k), for employees of government bodies, educational institutions, and charitable organizations

-

- Thrift Savings Plan (TSP)– Offered to federal employees, carefully managed to match market average and low management fees, guaranteed employer match from 1% to 5%, Roth TSP is an option (more on “roth” in the Roth IRA section)

-

- Pension – Offered by some employers, money you will begin to receive after age 65

It’s important that you take full advantage of these retirement benefits and max out your 401(k). Hospitals often offer attractive employer match rates, this is free money! The more you contribute, the more your employer will help fund your retirement.

Shorter Work Weeks

Nurses typically work three 12-hour shifts every week, for a total of 36 hours a week. There are pros and cons to this schedule.

The Pros:

-

- Less time commuting

-

- Easier to travel

-

- More flexibility

-

- Easier to manage childcare

The Cons:

-

- Difficult sleep schedule, especially for night shift

- Long days, 12 hours can become 16 hours depending on patient needs

- No downtime while on-shift

- Difficult to attend to health

As with all things, being a nurse can be a balancing act. With the flexible schedule and vacation days, there is a lot of potential for building an effective lifestyle to achieve early retirement. Time can be made to meal prep, look into personal finance, and learn about investing. Just make sure to also watch out for your own health not to overwork yourself.

Universal Tips for Early Retirement

No matter your profession, the fundamentals to achieving early retirement and financial independence remain the same. Earn more than you spend and invest the difference. We have a selection of articles that go over this in detail, from a detailed guide to FIRE essentials to the matter of health insurance for early retirees.

For now, let’s quickly go over the key ideas and examine how you can apply them, with your unique position as a nurse.

Make a Budget

In order to make more money than we spend, we have to be aware of our spending. If you don’t have one already, you need to make a budget. A good rule of thumb is to have two categories; essential and discretionary. Here’s a simple example of what your budget might look like.

Essentials

-

- Housing (rent or mortgage, includes property tax)

-

- Utilities (electricity, water, phone bill, wifi)

-

- Transportation (car loan, maintenance, parking fees, insurance, gas)

-

- Groceries (includes toiletries and other household items)

Discretionary

-

- Entertainment (hobbies)

-

- Travel

-

- Eating Out

-

- etc

This budget is not universal, you might have different categories, for example childcare, but it’s a good starting point. Whatever the case, the key is to spend less than you earn. Once you have some money saved, you’ll be able to invest it, and that’s where the magic happens.

But first!

Pay Off Your Debts!

If you don’t have any debt, then skip on ahead to the next step. If you do have debt, it’s no shame, but you do need to pay that off.

Generally speaking, if the annual interest rate on your debt is 5% or less, you can afford to prioritize investing. Historically, the US stock market returned an average of 7% per year, accounting for inflation. By investing in a broad-based index fund you’ll earn more money than you would have lost.

5-7% is trickier, as the market is prone to periodic downturns. Debt with 5-7% interest rates should also be paid off but they’re not quite as urgent as debt with a very high interest rate.

Finally, if your debt has an interest rate of 8%+ you need to pay that off ASAP. The higher the interest rate, the more important it is. High interest rate debt can grow to be incredibly unmanageable incredibly fast.

High Yield Savings Account

Once you’ve dealt with the debt, all that’s left is to save.

An easy but sometimes overlooked step in saving money is to open up an HYSA. It’s free and it’s fast. In fact, here’s an entire list from Nerd Wallet that you can choose from.

The usual interest you get from a bank is very low, the national average only around 0.45%. Unless you have expensive debt, putting your savings in an HYSA is always a good call.

To be safe, we recommend keeping an emergency fund that can cover at least 3 months of your expenses before graduating to investing.

Stock Investing 101

Here it is, the X factor. The secret krabby patty formula.

Investing is actually a lot simpler than most people think. As mentioned before, the US stock market has returned an average of 10%, or 7% after inflation, every year since its inception. To be a successful investor, all you really need to do is invest as much money as you can in a broad-based index fund every month and let it sit. Broad-based index funds like the S&P 500 are made to track the market and capture the total US market average.

Now, is it possible to become an investor who beats the market average? Of course. But it’s an endeavor that takes a lot of learning and dedication. Until then, let’s stick to the basics.

Okay, so I get 7%. What does that mean exactly?

It means you can lean into compound interest and become enormously wealthy.

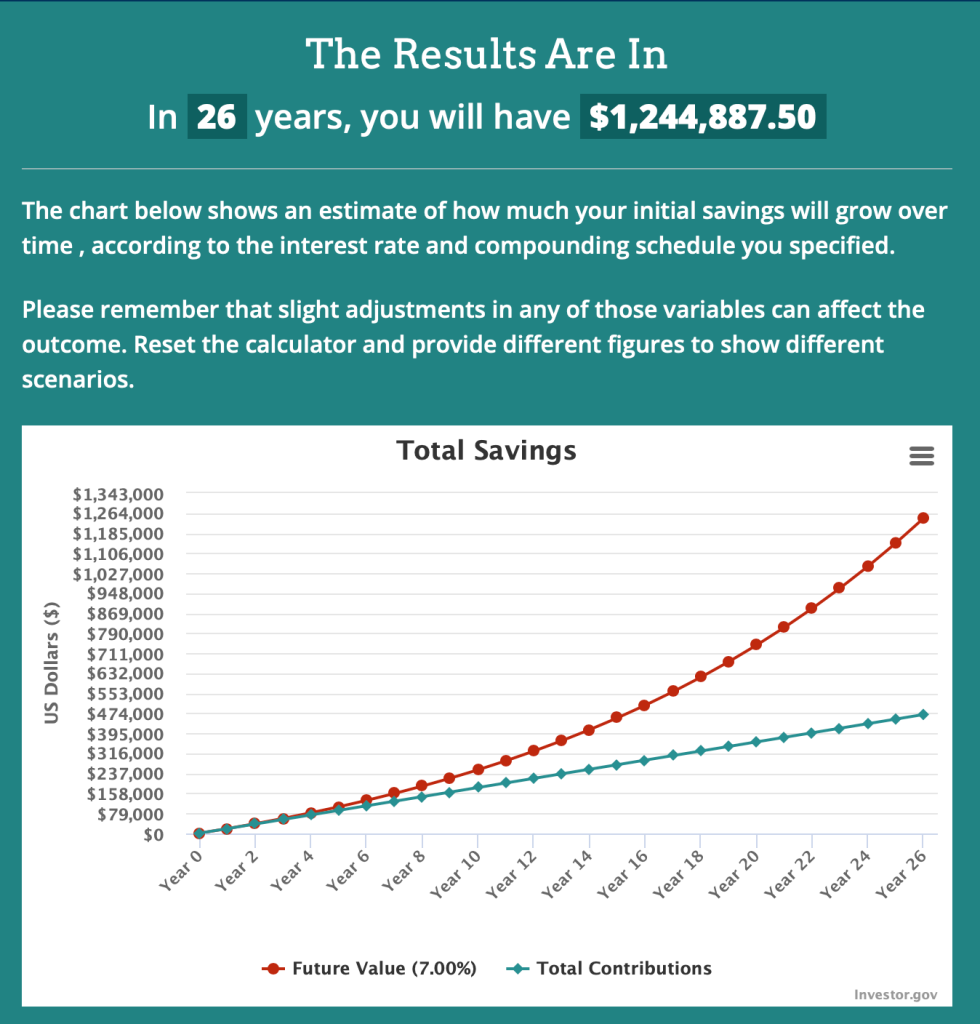

Let’s say every month you’re able to save $1500 of your take-home pay, which isn’t too much with a nurse’s paycheck. You’re currently 24 and you want to retire at 50. Will you have enough money to do so?

The 7% return specified here is adjusted for inflation. You will have more, but the purchasing power will remain $1.2mil, in today’s terms.

Please note: this is only a thought experiment. For simplicity’s sake, we’ve ignored the differentials you can receive, employer match, and potential income from HYSA, GIC, or any other financial vehicle. These are all factors that will lead to more money in your retirement.

And we still need to address one of the biggest drains on your income — tax.

Tax Shelters

To avoid getting hit with double income tax, you need to invest under a tax shelter.

There are many kinds of tax shelters, some of them independent, some of them offered by your employer. Earlier, we talked briefly about the various employer-sponsored tax shelters you might have available to you such as the 401(k), 403(b), and TSP.

Because employer-sponsored tax shelters have contribution limits and penalties for early withdrawal, those who plan to retire early often also look to other tax shelters as well.

Traditional/Roth IRA

“IRA” stands for Individual Retirement Account. Contribution limit for an IRA is much stricter than for 401(k). For 2024, the 401(k) contribution limit, not including employer match, is $23k while the contribution limit for IRA is $7K.

| Traditional IRA | Roth IRA |

| Tax-deferred dollars, pay tax upon withdrawal | Taxed dollars, pay tax before contribution, no tax upon withdrawal |

| Withdrawals before 59½ will be hit with a 10% penalty | No minimum withdrawal age or penalty |

| Must begin withdrawals by 73 or you’re subject to Required Minimum Distribution (RMD), which if you do not take the minimum withdraw, you’ll have to pay 25% in tax penalty | No maximum withdrawal age or penalty |

| No income-eligibility restrictions | Individuals who earn more than $146,000 after tax are not eligible to contribute to Roth. Households are limited to $230,000. (2024 numbers) |

In addition to 401(k) or similar employer-offered tax shelter, you are also free to open an IRA. As early retirees will not be able to access their tax-deferred investments for many years, having an IRA can be enormously helpful.

Health Savings Accounts

Individuals and families can set up HSAs, which let you grow your investments with tax benefits, specifically for healthcare expenses. You can deduct your HSA contributions from your taxes, and your money grows tax-deferred until you take it out. When you use the funds for qualified medical expenses, you won’t pay taxes on those withdrawals. The best part? After 65, you’ll be able to withdraw any amount you like, penalty free.

HSAs are a regularly overlooked tool for early retirement. However, as a nurse with an in-depth understanding of the healthcare system, you’ll be able to leverage this tool in ways that others are not.

Other Investments

Beyond the stock market, there exist other avenues of investment as well. We’ll explore them now, in descending order of most to least reliable.

Real Estate Investment

The best thing about real estate is that it serves a very functional and necessary purpose: shelter. Everyone needs some place to live and so there will always be a demand for real estate. Even after purchasing a property, real estate can continue to serve as an excellent asset if you rent it out for monthly income or sell it for a profit.

A few warnings about today’s real estate market:

-

- The housing market is going through a period of turbulence. There are concerns of a market crash in the coming decade

-

- Mortgage interest rates are currently quite high, hovering at around 7.2% nationwide. Recall what we said earlier about expensive debt

-

- Property ownership is expensive and depending on where you live, it may be more economical for you to save money by renting and investing the difference in the stock market

Regardless of what you decide, make sure to do your research and to keep your investments firmly within the bounds of affordability.

Bond Investment

Put simply, a bond is an agreement between you and a company or government, where you lend an agreed upon amount of money for an agreed upon period of time.

In exchange for borrowing your money, you will be paid in interest. Generally, the more secure the bond the lower the interest (US Treasury Bonds: ~4.5%) and the riskier the bond, the higher the interest (Junk Bonds: ~5.75%). A longer maturity period, aka the amount of time before your principal must be repaid, also means a higher interest.

In contrast to stocks and real estate, bonds aren’t ideal for asset appreciation. While rates may increase in the future, currently they can only be relied on to keep pace with inflation. Even so, bonds are an important investment tool, especially for investors nearing their retirement. While the volatility of the stock market can be managed with a long time horizon, moving your wealth from the volatile stock market to more stable bonds can bring much peace of mind for soon-to-be and post-retirees.

International Investment

The US is the world’s largest economy, but we shouldn’t be so quick to dismiss the international stage. You can stay close to developed economies like the EU to lower risk, or you can consider emerging markets, i.e. Brazil, Russia, India, China, and South Africa. These countries offer great potential for growth as they fully develop.

Depending on your risk tolerance and understanding of these economies, investing internationally can be a great way to diversify your portfolio.

Peer2Peer

A relatively new and untested method of borrowing and lending money. Peer2Peer investing is where you lend a fellow American money through an online platform and are paid back in interest. The platform vets the borrower’s credit score and allows you to split your investment across a number of borrowers to reduce the danger of default.

Art/Gold

An eccentric investment vehicle that is not without merit. Art and gold tend to retain value more than appreciate. As with P2P, you should not allocate any more than 5% of your investment portfolio to this category, as it’s both riskier and less likely to appreciate.

Conclusion

Although the path to early retirement is fairly universal across professions, nurses have an advantage. Nurses have more access to retirement benefits, they have a higher than average income, and their work week offers the flexibility they need to set up good frugal habits.

If you’re a registered nurse who aspires to early retirement and financial freedom, all it takes is some financial finagling and taking advantage of the benefits you’re afforded. Wherever you are in your financial journey, we wish you the best of luck!

Did you find this article helpful? Check out our other articles for more tips to accelerate your journey to Financial Independence!

Fire Through Geoarbitrage: Best Locations to Maximize Your Savings

WeFIRE Newsletter

A weekly roundup of money news, budgeting hacks, tax strategies, book reviews, and bursts of inspiration to support you on your path to financial independence.

Jenny Xu