Preface: This article is meant for those with zero financial experience, and/or low levels of income, but are interested in achieving FIRE in the future.

If you’ve been browsing online trying to learn more about FIRE with no knowledge of what a Roth IRA or brokerage account is, don’t worry. Most of the articles you will see talk about having to “save 25 times your expenses” or “invest in long-term assets like stocks or real estate.” Although true, it all sounds pretty vague with no concrete steps to actually reach those goals.

With no parents to guide us anymore, it can feel overwhelming, and the big question remains: where do we even begin? Well, you’ve come to the right place.

In this article, we’ll take you step by step through the practical actions you need to take to achieve FIRE as a beginner. Start by understanding your current financial situation by tracking your income, expenses, and savings. This initial assessment will help you identify areas to cut costs and boost savings. Set clear financial goals, such as your target retirement age and desired retirement savings, to provide direction and motivation. Budget effectively, prioritize investments, and maximize tax-advantaged accounts to grow your wealth. Additionally, exploring extra income streams like side hustles can accelerate your journey towards financial independence and early retirement.

No more talk; let’s dive right into it.

Step 1: Understand Your Financial Situation

Before you can embark on your retirement planning journey, it’s crucial to have a clear understanding of your current financial situation. This involves taking a close look at your income, expenses, debts, assets, and financial goals.

The first step is to track your income and expenses meticulously. Keep a detailed record of all your income sources, including salary, bonuses, side hustles, and any other sources of revenue. Similarly, track all your expenses, categorizing them into fixed expenses (rent, utilities, debt payments) and variable expenses (groceries, entertainment, dining out). By analyzing your income and expenses, you gain a clear understanding of how much you spend and earn. This clarity lays the foundation for your FIRE plan.

Step 2: Set up Your Goal

Remember, FIRE is NOT just for high-income earners. While it can be challenging, many people have achieved FIRE even while working minimum wage jobs. It just requires frugality and disciplined financial habits! Here’s a practical example:

Case Study: Living on $15 per Hour

- Monthly Budget:

- Income: $15 per hour x 40 hours per week x 4 weeks = $2,400 per month before taxes.

- Expenses: Rent ($600), Utilities ($100), Groceries ($200), Transportation ($100), Insurance ($100), Miscellaneous ($100). Total: $1,200.

- Savings Rate: $2,400 – $1,200 = $1,200 saved per month (50% savings rate).

- Investment Plan:

- Emergency Fund: Build a $3,000 emergency fund first.

- Investments: Invest $1,200 per month in low-cost index funds.

- Compounding: Assuming an average annual return of 7%, after 10 years, the investment of $1,200 per month would grow to approximately $198,956.85, thanks to compound interest.

- Long-Term Goals:

- Financial Independence: With consistent saving and investing, we can aim for a FIRE number of around $360,000 (based on annual expenses of $14,400 and the 25x rule). The 25x rule is a common guide in the FIRE community, which is calculated from 25 multiplied by total annual expense. This rule is based on historical market data and suggests that, in most cases, you can safely withdraw 4% (the reciprocal of 25) of your investment portfolio annually throughout your retirement without running out of money for at least 30 years.

- Retirement: Given our current income of $2400 per month and 50% savings rate which is put into a 7% return index fund, it would take approximately 15 years to reach our F.I.R.E number (assuming you start from a net worth of zero). For more detailed calculations, try our FIRE calculator.

Throughout the process, keep in mind that having a low income isn’t always a bad thing! As long as you are making enough to sustain a living, you can avoid paying excess taxes! Below is the 2024 tax bracket (via NerdWallet):

With an annual income of $14,400, assuming you file as a single person, the tax rate is only 12%. However, if your goal is to live more lavishly during retirement, it is important to boost earnings as much as possible.

Based on your FIRE number and desired retirement timeline, establish aggressive savings goals. Aim to save a significant portion of your income, ideally 50% or more. This may require making lifestyle adjustments and prioritizing saving over immediate gratification.

Step 3: Craft Investment Strategies

To achieve FIRE, the crucial step is to invest your savings wisely in appreciating assets, to ideally achieve a 7% annual return or higher. For those who do not have any investing experience, here’s a quick rundown:

Platforms to use for investments

- Online Brokerage Accounts

- Popular Choices: Fidelity, Charles Schwab, TD Ameritrade, E*TRADE, Robinhood, and Vanguard. Fidelity is probably the most beginner-friendly as it does not charge commission fees on any stock or ETF. The “Stocks by the Slice” option allows users to “sample” multiple stocks and test out the platform without risking too much money.

- Features: These platforms offer user-friendly interfaces, research tools, educational resources, and low or zero commission trades.

- How to Use:

- Open an account: Provide personal information and financial details.

- Fund your account: Transfer money from your bank account.

- Research and select stocks: Use the platform’s tools to find and analyze stocks.

- Place a trade: Enter the ticker symbol, choose the number of shares, and select the order type (market or limit).

- Mobile Trading Apps

- Examples: Robinhood, Webull, M1 Finance, Acorns.

Robinhood is a great pick for beginners who are looking for low-costs and the ability to build a diverse portfolio with limited capital. SoFi is popular for the same reasons, as well as its functionality and robo-advisor (an automated investing tool.)

- Advantages: Easy to use, convenient for on-the-go trading, often with no minimum account balance.

- How to Use:

- Download the app and create an account.

- Link your bank account and deposit funds.

- Browse stocks and ETFs.

- Buy or sell with a few taps.

- Full-Service Brokerage Firms

Full-service brokerage firms offer a wide range of financial services and personalized investment advice to clients. These firms typically provide more comprehensive services compared to discount brokers, including financial planning, research, portfolio management, and access to a dedicated financial advisor.

- Examples: Merrill Lynch, Morgan Stanley, Edward Jones.

- Features: Personalized financial advice, portfolio management, higher fees compared to online brokers.

- How to Use:

- Schedule a consultation with a financial advisor.

- Discuss your investment goals and risk tolerance.

- The advisor will execute trades on your behalf and manage your portfolio.

- Robo-Advisors

Robo-Advisors are becoming increasingly popular due to their low cost, user-friendly, and hands-off approach to investing. They also provide diversified, professionally managed portfolios, automated features, and financial planning tools that can help you achieve your financial goals with minimal effort and expertise.

- Examples: Betterment, Wealthfront, SoFi Invest.

- Advantages: Automated investing, low fees, personalized portfolios based on risk tolerance and goals.

- How to Use:

- Sign up and complete a questionnaire about your financial goals and risk tolerance.

- The robo-advisor creates a diversified portfolio for you.

- Funds are automatically invested and rebalanced as needed.

Passive Investing

Passive investing is exactly what the name suggests: investors put their money into vehicles that require minimal active management or ongoing effort. Also known as a buy-and-hold strategy, passive investing means holding a security over a long period of time with little trading, aiming for growth and stability. It is very low-maintenance, requiring much less time and effort compared to active investing. Typical passive investment vehicles include broad-based index funds and exchange-traded funds (ETFs).

1. Broad-based Index Funds

Broad-based index funds are designed to replicate the performance of a large segment of the financial market. These funds invest in a wide array of securities, providing diversified exposure across various industries and sectors. They are excellent for beginners because they offer diversification, lower fees, and an upward trend. Here are some popular broad-based index funds to consider:

- Vanguard Total Stock Market Index Fund (VTSAX)

- Tracks the performance of the CRSP US Total Market Index.

- Offers exposure to the entire U.S. equity market, including small-, mid-, and large-cap stocks.

- Schwab Total Stock Market Index Fund (SWTSX)

- Tracks the performance of the Dow Jones U.S. Total Stock Market Index.

- Provides exposure to the entire U.S. stock market.

- Fidelity Total Market Index Fund (FSKAX)

- Tracks the performance of the Dow Jones U.S. Total Stock Market Index.

- Offers broad exposure to the U.S. equity market.

- Vanguard 500 Index Fund (VFIAX)

- Tracks the performance of the S&P 500 Index.

- Focuses on large-cap U.S. stocks, representing about 500 of the largest U.S. companies.

- Vanguard Total International Stock Index Fund (VTIAX)

- Tracks the performance of the FTSE Global All Cap ex US Index.

- Provides exposure to non-U.S. developed and emerging markets.

- Fidelity International Index Fund (FSPSX)

- Tracks the performance of the MSCI EAFE Index.

- Offers exposure to developed international markets, excluding the U.S. and Canada.

These broad-based index funds provide diversified exposure to either the entire U.S. stock market or international markets, making them suitable for building a well-rounded investment portfolio.

When selecting an index fund, consider the following factors:

- Investment Goals: Align the fund with your investment objectives and risk tolerance. Look for upward-trending markets and invest in funds that focus on emerging markets with growth potential.

- Expense Ratio: Lower expense ratios are generally better, as they reduce the overall cost of investing.

- Minimum Investment: Some funds have minimum investment requirements, so ensure you can meet them.

- Tracking Error: The degree to which the fund’s performance deviates from the index it tracks should be minimal.

2. Exchange-Traded Funds (ETFs):

For the same reasons as broad-based index funds, Exchange-Traded Funds (ETFs) are great options for beginners as well. The major difference between index funds and ETFs is that ETFs are investment funds traded on stock exchanges, much like individual stocks. They offer a way to invest in a diversified portfolio of assets, including stocks, bonds, commodities, or a mix of these. Here are a few beginner-friendly ETFs:

Broad Market ETFs

- Vanguard Total Stock Market ETF (VTI)

- Tracks the performance of the CRSP US Total Market Index.

- Provides exposure to the entire U.S. stock market, including small-, mid-, and large-cap stocks.

- iShares Core S&P Total U.S. Stock Market ETF (ITOT)

- Tracks the S&P Total Market Index.

- Offers broad exposure to the U.S. equity market.

S&P 500 ETFs

- SPDR S&P 500 ETF Trust (SPY)

- Tracks the S&P 500 Index.

- Provides exposure to the 500 largest U.S. companies.

- Vanguard S&P 500 ETF (VOO)

- Tracks the S&P 500 Index.

- Known for its low expense ratio.

- iShares Core S&P 500 ETF (IVV)

- Tracks the S&P 500 Index.

- Offers a cost-effective way to invest in large-cap U.S. stocks.

International ETFs

- Vanguard Total International Stock ETF (VXUS)

- Tracks the FTSE Global All Cap ex US Index.

- Provides exposure to non-U.S. developed and emerging markets.

- iShares MSCI ACWI ex U.S. ETF (ACWX)

- Tracks the MSCI ACWI ex USA Index.

- Offers diversified exposure to international markets.

Bond ETFs

- Vanguard Total Bond Market ETF (BND)

- Tracks the Bloomberg Barclays U.S. Aggregate Float Adjusted Index.

- Provides exposure to a wide range of U.S. investment-grade bonds.

- iShares Core U.S. Aggregate Bond ETF (AGG)

- Tracks the Bloomberg Barclays U.S. Aggregate Bond Index.

- Offers broad exposure to the U.S. investment-grade bond market.

Dividend ETFs

- Vanguard Dividend Appreciation ETF (VIG)

- Tracks the NASDAQ US Dividend Achievers Select Index.

- Focuses on companies with a history of increasing dividends.

- iShares Select Dividend ETF (DVY)

- Tracks the Dow Jones U.S. Select Dividend Index.

- Provides exposure to high dividend-paying U.S. stocks.

Tips for Beginners

- Expense Ratios: Choose ETFs with low expense ratios to minimize costs.

- Diversification: Select ETFs that offer broad market exposure to reduce risk.

- Liquidity: Look for ETFs with high trading volumes to ensure ease of buying and selling.

- Investment Goals: Align your ETF choices with your investment objectives, risk tolerance, and time horizon.

These ETFs provide a good starting point for beginners, offering diversified exposure to various asset classes and markets.

Step 4: Maximize Retirement Accounts

Contributing to tax-advantaged retirement accounts, such as a 401(k) or an Individual Retirement Account (IRA), is a powerful strategy for building your retirement savings. These accounts offer significant tax benefits that can help your savings grow faster. For instance, contributions to a traditional 401(k) or IRA are often tax-deductible, which can reduce your taxable income in the year you make the contribution. Additionally, the investments within these accounts grow tax-deferred until you withdraw the money in retirement, allowing your savings to compound more efficiently over time.

Take IRAs (Individual Retirement Accounts) as an example. There are a few different types, including Traditional IRA, Roth IRA, SEP (Simplified Employee Pension) IRA, SIMPLE (Savings Incentive Match Plan for Employees) IRA. They offer various tax benefits, which can either reduce your taxable income now or provide tax-free withdrawals in retirement. Below, we’ll go more into depth on each type.

1. Traditional IRA:

This one is best-suited for people who will retire in a lower tax bracket than at the time of contributions to the IRA. (For example, a senior software engineer who earns $120,000 per year retires and works in part-time consulting for $10,000 a year.) This is because the contributions to the traditional IRA are not taxed, but withdrawals are, and you will be taxed based on the bracket that you are in at the moment of withdrawal.

- Contributions: Made with pre-tax dollars, which means you may be able to deduct them from your taxable income.

- Tax Benefits: Contributions may be tax-deductible, reducing your current taxable income.

- Growth: Investments grow tax-deferred, meaning you don’t pay taxes on earnings until you withdraw them.

- Withdrawals: Taxable upon withdrawal; required minimum distributions (RMDs) must start at age 73.

- Contribution Limits: For 2024, the limit is $6,500 per year ($7,500 if you’re 50 or older).

2. Roth IRA:

This one offers more beneficial options for those with lower incomes and are looking to earn more in the future, due to its deferred tax advantage. Unlike traditional IRAs, the contributions are taxed while withdrawals are not. Therefore, you want to be taxed while you are in a lower bracket compared to at a higher bracket upon retirement.

- Contributions: Made with after-tax dollars, which means they are not tax-deductible.

- Tax Benefits: Qualified withdrawals are tax-free, including earnings.

- Growth: Investments grow tax-free.

- Withdrawals: Contributions can be withdrawn anytime tax-free and penalty-free; earnings can be withdrawn tax-free after age 59½, provided the account has been open for at least five years. No RMDs during the account holder’s lifetime.

- Contribution Limits: Same as Traditional IRA: $6,500 per year ($7,500 if you’re 50 or older).

- Income Limits: Contribution eligibility phases out at higher income levels ($138,000 to $153,000 for single filers, and $218,000 to $228,000 for married couples filing jointly in 2024).

3. SEP IRA (Simplified Employee Pension):

- For: Self-employed individuals and small business owners.

- Contributions: Made by the employer; can be up to 25% of the employee’s compensation or $66,000 (for 2023), whichever is less.

- Tax Benefits: Contributions are tax-deductible for the business.

- Growth: Investments grow tax-deferred.

- Withdrawals: Same as Traditional IRA; taxable upon withdrawal, with RMDs starting at age 73.

4. SIMPLE IRA (Savings Incentive Match Plan for Employees):

- For: Small businesses with 100 or fewer employees.

- Contributions: Both employer and employee can contribute. Employees can defer up to $15,500 annually (as of 2024), with a $3,500 catch-up contribution if they are 50 or older.

- Tax Benefits: Employee contributions are tax-deferred, and employer contributions are tax-deductible.

- Growth: Investments grow tax-deferred.

- Withdrawals: Same as Traditional IRA; taxable upon withdrawal, with RMDs starting at age 73.

Key Considerations for IRAs

1. Contribution Limits and Deadlines:

- Contribution limits apply to all your IRAs combined. The deadline for contributions is usually the tax filing deadline (April 15th) of the following year.

2. Eligibility and Income Limits:

- Traditional IRA contributions are not limited by income, but deductibility may be phased out if you or your spouse is covered by a retirement plan at work and your income exceeds certain levels.

- Roth IRA contributions are subject to income limits.

3. Withdrawal Rules and Penalties:

- Withdrawals from a Traditional IRA before age 59½ may incur a 10% early withdrawal penalty, in addition to being taxed as income.

- Roth IRA contributions can be withdrawn at any time without penalty, but early withdrawal of earnings may incur penalties unless certain conditions are met.

4. Investment Options:

- IRAs can hold a variety of investments, including stocks, bonds, mutual funds, ETFs, and other securities. Some IRAs even allow for real estate and other non-traditional investments.

Example Scenario

Case Study: Choosing Between Traditional and Roth IRA

- Maria’s Situation:

- Age: 30

- Annual Income: $70,000

- Current Tax Bracket: 22%

- Retirement Age: 65

- Expected Retirement Tax Bracket: 24%

- Traditional IRA:

- Contribution: $6,500

- Immediate Tax Savings: $6,500 x 22% = $1,430

- Future Taxes on Withdrawals: Contributions and earnings will be taxed at 24% upon withdrawal.

- Roth IRA:

- Contribution: $6,500 (no immediate tax savings)

- Tax-Free Withdrawals: Contributions and earnings can be withdrawn tax-free in retirement.

Decision Factors:

- Maria expects to be in a higher tax bracket in retirement, so a Roth IRA might be more beneficial due to the tax-free withdrawals.

- If Maria needs the immediate tax deduction to reduce her current taxable income, a Traditional IRA could be advantageous.

IRAs are powerful tools for retirement savings, offering significant tax advantages and flexibility. Understanding the different types of IRAs, their benefits, and their limitations can help you make informed decisions about which one(s) best fit your financial situation and retirement goals. Whether you choose a Traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA, the key is to start early, contribute regularly, and invest wisely.

Optional Step: Side Quests

As babies, our attention spans tend to be on the short end––according to CNLD Testing and Therapy, 2-3 year olds have an average span of 4-8 minutes. Coincidentally, when it comes to finance, it’s also a good idea to switch things up and engage in a few side quests while chasing FIRE. This can not only provide variety, but also bring other avenues for personal growth and fulfillment.

Assuming that you aren’t pursuing your hobbies or passions for your current job, think of some that you would consider trying to monetize on. Maybe you could start a side business selling those knitted scarves you make for friends and family, or upload some of those songs you recorded in your bedroom. Especially if your main job drains your everyday energy, it might be a good idea to look into other avenues for fulfillment. Here are a few ideas:

1. Freelancing and Gig Economy:

- Freelancing: Offer your skills on platforms like Upwork, Fiverr, or Freelancer. Common services include writing, graphic design, web development, and consulting.

- Gig Economy: Participate in gig economy jobs like driving for Uber/Lyft, delivering for DoorDash/Postmates, or completing tasks on TaskRabbit.

2. Online Businesses:

- E-commerce: Start an online store using platforms like Etsy, Shopify, or eBay. Sell handmade items, vintage finds, or dropship products.

- Content Creation: Create a blog, YouTube channel, or podcast on topics you’re passionate about. Monetize through ads, sponsorships, and affiliate marketing.

3. Investing in Real Estate:

- Rental Properties: Purchase properties to rent out. This can provide a steady stream of passive income and potential appreciation in property value.

- House Hacking: Buy a multi-family property, live in one unit, and rent out the others. This can help cover your mortgage and living expenses.

4. Enhance Your Career:

- Certifications and Courses: Invest in certifications or courses that can help you advance in your current job or pivot to a higher-paying career.

- Networking: Build a professional network to discover new opportunities and gain insights from industry peers.

5. Financial Education:

- Read Books and Blogs: WeFIRE, although a great resource, can only educate you so much. Learn more about personal finance, investing, and F.I.R.E. strategies through reputable books and blogs.

- Podcasts and Webinars: Listen to finance podcasts and attend webinars to stay updated on financial trends and tips.

Pursuing side quests while working towards F.I.R.E. involves a mix of increasing income, reducing expenses, continuous learning, and strategic investing. By diversifying your efforts across these areas, you can accelerate your journey to financial independence and early retirement. The key is to stay disciplined, keep learning, and adapt your strategies as needed to stay on track with your goals.

Conclusion

In this article we focused on the basics of FIRE: from setting a goal to budgeting based on your income and expenses, to investing and setting up retirement funds, and engaging in side hustles along the way. It might seem pretty intimidating to embark on this journey alone, especially as a babyFIRE, but just remember that everyone is capable of achieving their goals with the right mindset and enough effort. In the meantime, let’s take it slow, one step––or fund––at a time.

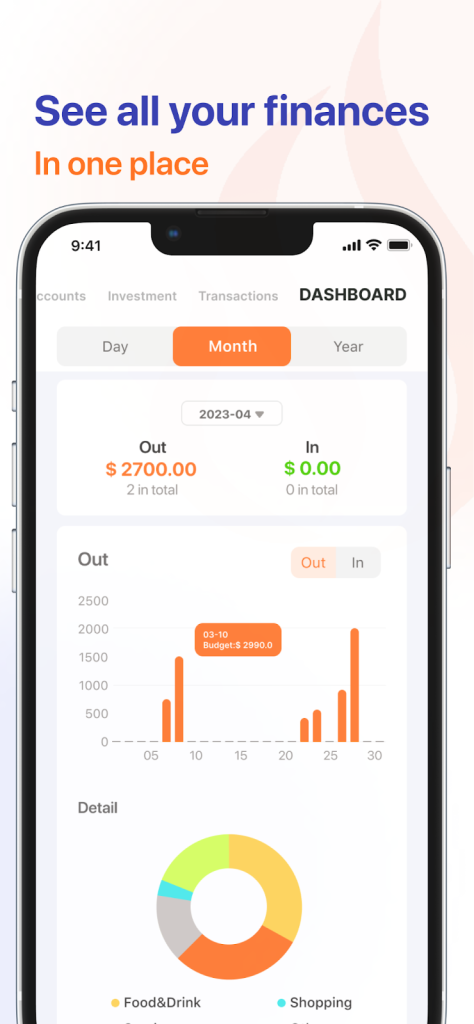

Our team at WeFIRE hope this was helpful for those of you starting out, and if it was, consider trying out our app to help budget and jumpstart your FIRE journey!

WeFIRE Newsletter

A weekly roundup of money news, budgeting hacks, tax strategies, book reviews, and bursts of inspiration to support you on your path to financial independence.

One Response

Oh my goodness! Amazing article dude! Many thanks, However I am having problems with your RSS. I don’t understand the reason why I cannot join it. Is there anybody else getting similar RSS problems? Anyone that knows the solution can you kindly respond? Thanks!!