The FIRE (Financial Independence, Retire Early) movement has captured the imaginations of countless individuals seeking to break free from the traditional 9-to-5 grind and embrace a life of financial freedom and flexibility. At its core, FIRE is about accumulating enough wealth to live off of your investments, allowing you to retire far earlier than the conventional retirement age. While the allure of early retirement is undeniable, achieving FIRE requires careful planning and disciplined execution.

One of the most critical components of any successful FIRE journey is budgeting. A well-crafted FIRE budget isn’t just about cutting back on lattes or canceling subscriptions; it’s a comprehensive financial roadmap that guides your spending, saving, and investing decisions. It’s the foundation upon which your financial independence is built.

In this ultimate guide to FIRE budgeting, we’ll delve into the strategies, tactics, and mindset shifts necessary to create a budget that aligns with your FIRE goals. We’ll cover everything from calculating your FIRE number to optimizing your spending and maximizing your savings. Whether you’re just starting your FIRE journey or looking to fine-tune your existing budget, this guide will provide you with the tools and knowledge you need to achieve financial independence and retire early.

1.FIRE Budgeting Fundamentals

Lesson 1: Understanding FIRE: Definitions, Goals, and Variations

The FIRE (Financial Independence, Retire Early) movement is an increasingly popular lifestyle choice that centers around achieving Financial Independence (FI) to facilitate early retirement (RE).

- Financial Independence (FI): FI represents the financial milestone where your passive income—generated through investments, dividends, rental income, or other sources—can sustain your desired lifestyle without relying on a traditional job. It’s about having enough saved and invested that your money works for you, covering your living expenses and providing financial security.

- Retire Early (RE): In the FIRE community, Retire Early (RE) is often seen as the ultimate goal, enabling individuals to leave the workforce well before the traditional retirement age. However, reaching Financial Independence (FI) doesn’t mean you have to retire. It’s a personal choice. FI provides the freedom to decide whether to stop working entirely, pursue personal interests, travel, spend more time with family, or continue working in a role or project you’re passionate about. The key is having the financial security to live life on your own terms.

The beauty of FIRE is its flexibility. There isn’t a single, rigid definition of what it looks like. Instead, FIRE encompasses a wide range of lifestyles and goals:

- Lean FIRE: This approach prioritizes extreme frugality and minimalist living. Lean FIRE enthusiasts aim to achieve FI with the smallest possible nest egg, often by significantly cutting back on expenses and living well below their means.

- Fat FIRE: Individuals pursuing Fat FIRE strive for a more luxurious early retirement. They save and invest aggressively to build a larger nest egg, allowing them to maintain a higher standard of living and potentially indulge in travel, hobbies, and other passions.

- Barista FIRE: This hybrid approach combines part-time work with financial independence. Barista FIRE proponents may work a few hours a week at a job they enjoy (like being a barista), supplementing their passive income and maintaining social connections.

- Coast FIRE: This strategy involves reaching a point where you no longer need to save actively for retirement. Instead, your investments are projected to grow enough to cover your future expenses, allowing you to “coast” into retirement without further contributions.

The path to FIRE is highly individualized. Your financial goals, risk tolerance, spending habits, and ideal retirement lifestyle will all play a crucial role in determining your unique FIRE strategy. Whether you envision a simple, frugal existence or a life filled with adventure and indulgence, tailoring your approach is key to successfully achieving your FIRE dreams.

Lesson 2: Calculating Your FIRE Number: The Key to Financial Independence

Your FIRE (Financial Independence, Retire Early) number is the financial target you need to hit to unlock the freedom of early retirement. It represents the total amount of money you need to have saved and invested so that your passive income can cover your living expenses without relying on traditional employment.

The most widely used method for calculating your FIRE number is the 4% rule, also known as the safe withdrawal rate (SWR). This rule is based on historical market data and suggests that, in most cases, you can safely withdraw 4% of your investment portfolio annually throughout your retirement without running out of money over a 30-year period.

How to Calculate Your FIRE Number

- Estimate your annual expenses: Determine how much you anticipate spending each year in retirement. This includes everything from housing and food to travel and entertainment. Be realistic and consider potential lifestyle changes or inflation.

- Multiply by 25: Multiply your estimated annual expenses by 25 to get your FIRE number. This is because dividing your annual expenses by 4% (the SWR) is the same as multiplying by 25. For example, If you estimate your annual retirement expenses to be $50,000, your FIRE number would be $1,250,000 ($50,000 x 25).

Reminder 1: The 4% Rule: A Guideline, Not a Law

It’s important to remember that the 4% rule is not set in stone. It’s a guideline based on historical data, but your actual safe withdrawal rate can vary depending on various factors:

- Investment returns: If your investments perform better than expected, you may be able to withdraw more than 4% annually. Conversely, lower returns may require you to reduce your withdrawals.

- Inflation: Inflation can erode the purchasing power of your savings over time, so it’s important to adjust your withdrawals accordingly.

- Unexpected expenses: Life is unpredictable, and unexpected expenses like medical bills or home repairs can impact your retirement budget.

Reminder 2: Regularly Reassess Your FIRE Number

Your financial situation and goals may change over time, so it’s crucial to revisit your FIRE number periodically. Assess your investment performance, adjust your spending habits as needed, and factor in any changes in your retirement plans. By staying proactive, you can ensure that you’re on track to achieve financial independence and enjoy the retirement you’ve always dreamed of.

Lesson 3: FIRE Budgeting vs. Traditional Budgeting

Traditional budgeting often focuses on managing day-to-day expenses and ensuring you have enough money to cover bills and discretionary spending. While essential, this approach doesn’t necessarily prioritize long-term financial goals like early retirement.

FIRE budgeting, on the other hand, is laser-focused on maximizing savings and investments. It involves making deliberate choices to reduce expenses, increase income, and allocate a significant portion of your earnings towards building your investment portfolio. FIRE budgeting is about delayed gratification and investing in your future self.

Key Differences:

Feature | Traditional Budgeting | FIRE Budgeting |

Primary focus | Managing current expenses and debt | Maximizing savings and investments for early retirement |

Time horizon | Short-term: monthly or annual | Long-term: decades |

Spending Philosophy | Live within your means, balance needs and wants | Mindful spending, prioritize financial goals |

Saving rate | Typically lower, often determined by leftover income | Significantly higher, often 50% or more of income |

Investment strategy | May be conservative or moderate | Sometimes more aggressive to grow wealth faster |

FIRE budgeting isn’t about deprivation. It’s about conscious choices and aligning your spending with your long-term goals. It encourages you to question every expense and ask yourself, “Does this bring me closer to financial independence?”

By adopting a FIRE mindset and implementing its budgeting principles, you can supercharge your savings, accelerate your investment growth, and ultimately pave the way to financial freedom and the early retirement you desire.

Lesson 4: Myth vs. Reality – Debunking Common Misconceptions

The path to Financial Independence and Early Retirement (FIRE) is often shrouded in misconceptions about budgeting. Let’s tackle some of the most common ones head-on:

Myth 1: FIRE Budgeting Means Extreme Deprivation

Reality: While FIRE does involve intentional spending and prioritizing savings, it doesn’t equate to a life devoid of joy or pleasure. It’s about conscious consumption, spending on what truly matters to you, and finding creative ways to reduce unnecessary expenses. You can still enjoy hobbies, travel, and experiences while diligently working towards your FIRE goals.

Myth 2: FIRE is Only for High Earners

Reality: Achieving FIRE isn’t exclusive to those with six-figure salaries. While a higher income can accelerate your journey, it’s ultimately your savings rate that determines your success. Individuals with modest incomes can also reach FIRE through disciplined budgeting, smart investments, and a commitment to their financial goals.

Myth 3: FIRE Budgeting is Overly Restrictive

Reality: FIRE budgeting is about aligning your spending with your values and long-term goals. It’s a flexible framework that allows you to adjust your spending based on your individual circumstances and priorities. You can create a budget that works for you, allowing for both savings and enjoyment.

Myth 4: You Have to Sacrifice Your Social Life to Achieve FIRE

Reality: Building a social life and pursuing FIRE aren’t mutually exclusive. It’s about finding affordable ways to connect with friends and family, focusing on experiences over material possessions. Many FIRE enthusiasts find that their social circles actually expand as they connect with like-minded individuals who share similar values and goals.

Key Takeaway:

FIRE budgeting is not about restriction; it’s about empowerment. It gives you control over your finances, enabling you to make informed decisions that align with your long-term aspirations. By debunking these myths and understanding the true nature of FIRE budgeting, you can embark on your FIRE journey with confidence and clarity.

2. Crafting Your FIRE Budget: A Step-by-Step Guide

Step 1: Track Your Income and Expenses

To build a solid FIRE plan, you must have an accurate picture of your financial landscape. This begins with meticulous tracking of every dollar that enters and exits your life. Think of it as a financial X-ray, revealing the strengths and weaknesses of your spending habits.

1.1 Tools of the Trade:

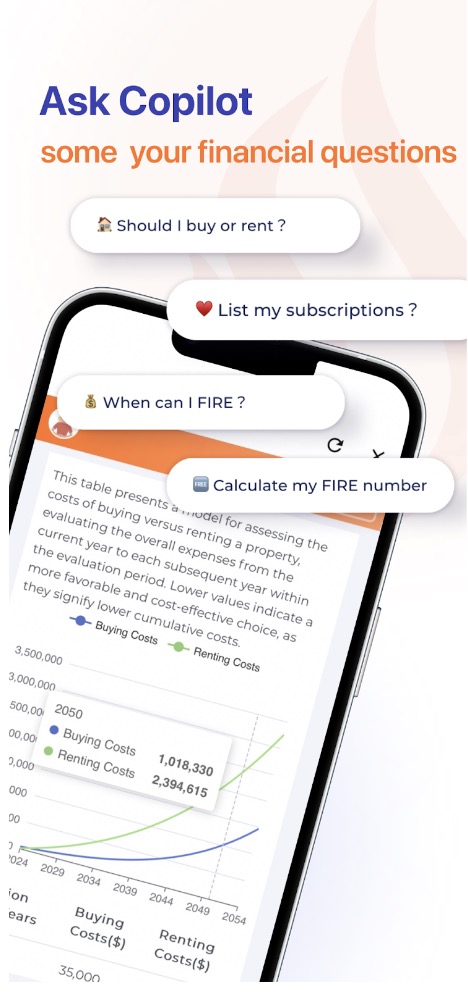

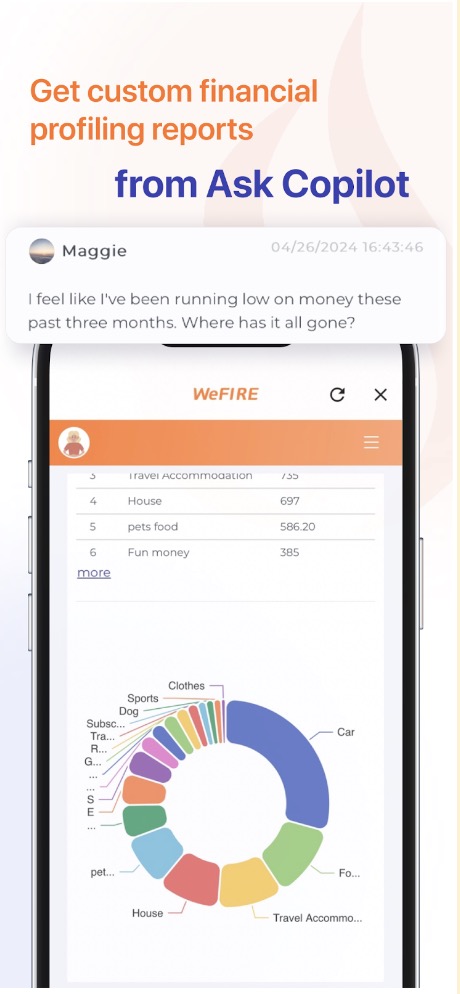

- WeFIRE App: This app, designed specifically for FIRE enthusiasts, offers a user-friendly interface to track income, expenses, investments, and net worth. It provides goal-setting features, progress tracking, and even a FIRE calculator. Additionally, WeFIRE’s AI-powered analysis can help you identify spending patterns, optimize your budget, and discover potential savings opportunities.

- Spreadsheets: If you prefer a DIY approach, create a simple spreadsheet to log your income and expenses. Customize it to your liking, adding categories that reflect your unique spending patterns.

- The Old-School Notebook: Sometimes, a pen and paper are all you need. Jot down every expense in a dedicated notebook. It might seem tedious, but it forces you to be mindful of each transaction.

1.2 Categorizing is Key:

Divide your expenses into meaningful categories to gain insights into your spending habits. Common categories include:

- Housing: Rent/mortgage, property taxes, insurance, maintenance

- Transportation: Car payments, gas, public transportation, parking

- Food: Groceries, dining out, takeout

- Utilities: Electricity, gas, water, internet, phone

- Healthcare: Insurance premiums, doctor visits, prescriptions

- Debt Payments: Student loans, credit cards, personal loans

- Personal Care: Haircuts, toiletries, gym memberships

- Entertainment: Movies, concerts, hobbies

- Savings & Investments: Retirement contributions, emergency fund, brokerage accounts

- Other: Gifts, donations, miscellaneous expenses

The more detailed your categorization, the better you’ll understand where your money is going and identify potential areas for savings.

Step 2: Analyze Your Spending Habits

Armed with several months of spending data, it’s time to dissect your habits like a financial detective.

2.1 Needs vs. Wants:

Distinguish between your “needs” and “wants.”

- Needs: These are the essentials for your survival and well-being, such as housing, food, utilities, transportation, and basic healthcare.

- Wants: These are the extras that enhance your life but aren’t strictly necessary, such as dining out, entertainment, hobbies, and luxury items.

Challenge yourself to honestly assess each expense. Is it truly a need, or is it a want disguised as a need? Be ruthless in your evaluation, as cutting back on wants is often the quickest path to increased savings.

2.2 Look for Leaks:

Scrutinize your spending for recurring expenses that can be trimmed or eliminated. These “budget leaks” can include:

- Subscriptions and Memberships: Unused gym memberships, streaming services you rarely watch, magazine subscriptions you don’t read.

- Dining Out: Frequent restaurant meals and coffee shop visits can add up quickly. Consider cooking at home more often or packing lunches.

- Impulse Purchases: Those “treat yourself” moments can sabotage your savings. Practice mindful spending and avoid impulse buys.

2.3 The Pareto Principle:

The Pareto Principle, also known as the 80/20 rule, suggests that 80% of your results come from 20% of your efforts. Apply this to your budget by focusing on the categories where you spend the most money. Even small reductions in these areas can have a significant impact on your overall savings.

Step 3: Set Ambitious Savings Goals

Based on your FIRE number and desired retirement timeline, establish aggressive savings goals. Aim to save a significant portion of your income, ideally 50% or more. This may require making lifestyle adjustments and prioritizing saving over immediate gratification.

Step 4: Optimize Your Expenses

Every dollar you don’t spend is a dollar you can save and invest, accelerating your path to FIRE. There are countless ways to reduce your living costs without sacrificing your quality of life:

4.1 Housing:

- Downsize: If your current home is larger than you need, consider downsizing to a smaller house or apartment. This can significantly reduce your mortgage or rent payments, property taxes, and utility bills.

- Relocate: Explore more affordable areas to live. Moving to a different city or region with a lower cost of living can free up a substantial amount of money each month.

- House Hacking: Consider renting out a room or portion of your home to generate additional income and offset your housing costs.

- Refinance Your Mortgage: If interest rates have dropped, refinancing your mortgage could lower your monthly payments and save you thousands over the life of the loan.

4,2 Transportation:

- Ditch the Car: If possible, consider living in a walkable or bikeable area where you can rely less on a car. Public transportation, carpooling, and rideshare services are also viable alternatives.

- Drive a Used Car: New cars depreciate rapidly. Opt for a reliable used car in good condition to save money on the purchase price, insurance, and registration.

- Maintain Your Vehicle: Regular maintenance can prevent costly repairs and extend the life of your car.

- Shop Around for Car Insurance: Compare rates from different insurers to find the best deal. Bundling your auto and home insurance can often result in discounts.

4.3 Food:

- Cook at Home: Dining out and takeout can be budget busters. Make cooking at home a priority. It’s healthier, cheaper, and allows you to control your portion sizes.

- Meal Planning and Prep: Plan your meals for the week and prep ingredients in advance to avoid last-minute takeout temptations.

- Pack Your Lunch: Bringing your lunch to work or school can save you a significant amount of money over time.

- Shop Smart: Look for sales, use coupons, buy in bulk (if it makes sense for your household), and compare prices at different stores. Consider generic brands for some items to save even more.

- Grow Your Own Food: If you have the space, consider starting a garden to grow your own fruits, vegetables, and herbs. This can be a rewarding way to save money and enjoy fresh, healthy produce.

4.4 Entertainment:

- Embrace Free or Low-Cost Activities: Look for free events in your community, explore local parks and nature trails, visit museums on free admission days, and enjoy board game nights or movie nights at home with friends.

- Borrow Books and Movies: Instead of buying books and movies, borrow them from your local library or use a streaming service.

- Learn New Skills: Take up a new hobby or skill that doesn’t require a lot of expensive equipment or materials. Consider learning to cook, knit, play an instrument, or practice yoga at home.

4.5 Other Expenses:

- Reduce Energy Consumption: Lower your utility bills by unplugging electronics when not in use, using energy-efficient appliances, and adjusting your thermostat.

- Shop Around for Insurance: Review your insurance policies (home, auto, health, life) regularly and compare quotes from different providers to ensure you’re getting the best rates.

- Cut Cable: If you don’t watch much TV, consider cutting the cord and using streaming services instead. This can save you a significant amount each month.

- Review Your Subscriptions: Cancel any subscriptions you don’t use or need, such as gym memberships, magazine subscriptions, and streaming services.

- Shop Secondhand: Consider buying used clothing, furniture, and other items from thrift stores or online marketplaces. You can often find high-quality items for a fraction of the price.

Step 5: Boost Your Income

While optimizing your expenses is crucial, increasing your income is like adding rocket fuel to your FIRE journey. The more you earn, the more you can save and invest, accelerating your path to financial independence.

5.1 Level Up Your Career:

- Seek Promotions: If you enjoy your current career path, explore opportunities for advancement within your company. Take on additional responsibilities, develop new skills, and actively seek out promotions that come with higher salaries.

- Negotiate a Raise: Don’t be afraid to ask for what you’re worth. Research salary trends in your industry, document your accomplishments, and confidently negotiate a raise with your employer.

- Consider a Career Change: If you’re feeling stuck in your current job or your income potential is limited, explore career options with higher earning potential. Research industries that are in demand and consider acquiring additional skills or certifications to make yourself a more attractive candidate.

5.2 Start a Side Hustle:

- Freelancing or Consulting: Leverage your existing skills and experience to offer freelance services or consulting in your field. This can be a great way to earn extra income on your own terms.

- Online Business: Start an online store, offer digital products or courses, or monetize a blog or YouTube channel. The possibilities are endless in the digital world.

- Gig Economy: Explore opportunities like driving for a rideshare service, delivering food, or completing tasks on platforms like TaskRabbit. These gigs offer flexibility and can supplement your income.

- Passive Income Streams: Consider investing in dividend-paying stocks, rental properties, or creating digital products that generate ongoing income with minimal effort.

5.3 Invest in Your Education and Skills:

- Continuing Education: Take courses, workshops, or online programs to expand your skill set and make yourself more marketable to employers.

- Professional Development: Attend conferences, workshops, and networking events to stay up-to-date on industry trends and connect with potential employers or clients.

- Certifications: Consider earning certifications relevant to your field to demonstrate your expertise and increase your earning potential.

5.4 Try Investing and Make Your Money Work For You

- Harness the Power of Compound Growth: Even a small initial investment can grow significantly over time due to the power of compound interest. By investing early and consistently, you can leverage this growth to your advantage.

- Start with the Basics: If you’re new to investing, begin with the fundamentals. Learn about different investment options like stocks, bonds, mutual funds, and real estate.

- Consider Index Funds: For many FIRE enthusiasts, index funds are a popular choice. They offer broad diversification, low fees, and a history of solid long-term returns.

- Seek Professional Guidance (Optional): If you’re unsure where to start or need personalized advice, consider working with a fee-only financial advisor. They can help you create an investment plan that aligns with your FIRE goals and risk tolerance.

5.5 Other Strategies:

- Sell Unwanted Items: Declutter your home and sell unwanted items online or at a garage sale. This can generate extra cash and simplify your life.

- Rent Out Unused Space: If you have a spare room, parking space, or storage area, consider renting it out for additional income.

- Take on a Second Job: If you have the time and energy, a part-time job can provide a significant boost to your income.

Step 6: Review and Adjust Regularly

Your FIRE budget is a living document that should evolve with your circumstances. Review it regularly to track your progress, identify areas for improvement, and celebrate your achievements. Life throws curveballs, so be prepared to adjust your budget as needed. Flexibility and adaptability are key traits of successful FIRE enthusiasts.

3. Conclusion

Achieving FIRE is a journey that requires dedication, discipline, and a well-structured budget. By tracking your income and expenses, analyzing your spending habits, setting ambitious savings goals, optimizing your expenses, and increasing your income, you can pave the path to financial independence and early retirement.

Remember, FIRE budgeting isn’t about deprivation; it’s about making conscious choices that align with your long-term goals. It’s about finding a balance between enjoying the present and investing in your future. With the right tools, resources, and mindset, you can take control of your finances, achieve financial freedom, and design a life on your own terms.

So, what are you waiting for? Start your FIRE journey today!

Ready to explore more? These articles offer diverse perspectives on financial independence:

The Financially Independent Mindset – Your Money or Your Life

9 Steps to Financial Independence – Your Money or Your Life

Pursuing Financial Independence: How to Build a Solid Financial Plan

How to Plan for Early Retirement: A Step-by-Step Guide

Am I Too Old to Start Saving for Retirement?

WeFIRE Newsletter

A weekly roundup of money news, budgeting hacks, tax strategies, book reviews, and bursts of inspiration to support you on your path to financial independence.

Ellie Yan